What is SBLC Monetization?

SBLC monetization refers to the process of converting a Standby Letter of Credit (SBLC) into liquid cash or a line of credit. This financial practice is often used to unlock capital from an SBLC without having to sell the instrument itself. Through monetization, an SBLC holder can obtain funds for business expansion, project financing, or other purposes, while still retaining ownership of the underlying SBLC.

The process involves using the SBLC as collateral for a loan or a line of credit, allowing the owner to access liquidity. A monetized SBLC is typically used for short-term funding needs, high-return investments, or other strategic financial activities.

Why Monetize an SBLC?

Monetization of an SBLC is beneficial for companies, investors, and high-net-worth individuals who require immediate liquidity without selling off assets or using traditional loans. By leveraging an SBLC, the owner can access funds to:

- Fund new projects

- Expand business operations

- Enter high-return investment programs (e.g., Private Placement Programs (PPP))

- Manage cash flow and liquidity needs

The monetization process provides a practical alternative for those who want to retain their assets while still obtaining working capital or financing.

How Does SBLC Monetization Benefit the Financing Entity?

For the entity providing the monetization service (typically a bank or a private financial

institution), the SBLC acts as secure collateral, reducing the risk involved in lending.

These entities are incentivized to offer financing because:

- Low Risk: The SBLC is a bank-issued, highly secure financial instrument, minimizing the risk of default.

- Guaranteed Repayment: The issuer of the SBLC guarantees payment in caseof default by the client, which adds another layer of protection for the financing entity.

- Return on Investment: The monetizing entity earns interest or fees for providing the liquidity, making it a profitable transaction.

Monetizing SBLCs can be lucrative for financiers due to the security and relatively low-

risk profile of the underlying asset, particularly when dealing with high-value SBLCs

from reputable financial institutions.

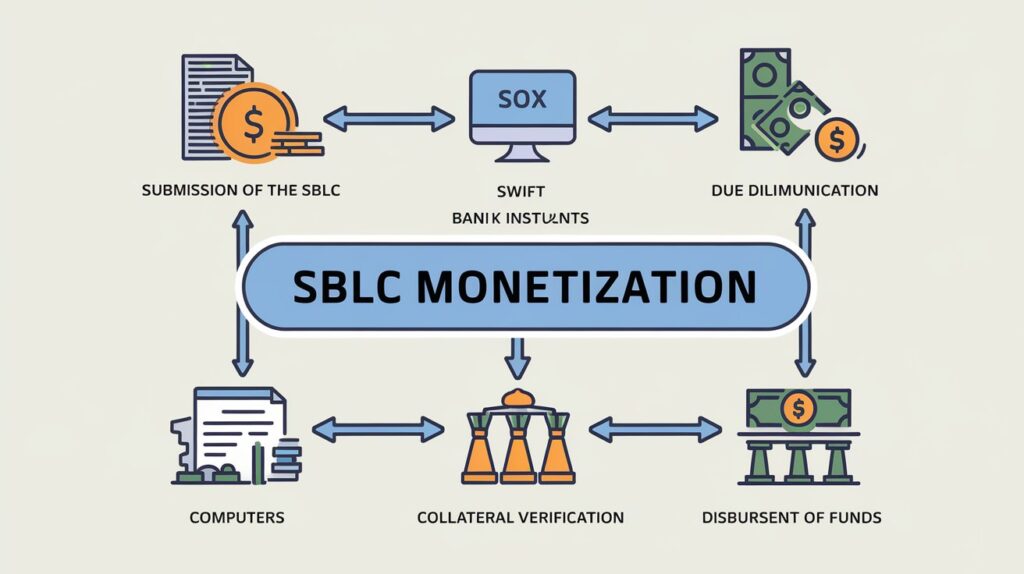

The SBLC Monetization Process

- Submission and Due Diligence: The SBLC holder approaches a bank or financial institution with the SBLC. The monetizing entity conducts a due diligence process to verify the authenticity of the SBLC, ensuring that it is issued by a top-rated bank and is a valid, active instrument. The SBLC must typically be cash-backed and issued via a secure banking communication network like SWIFT.

- Bank Communication via SWIFT: If the SBLC is valid, the monetizing entity will communicate with the issuing bank using SWIFT, a secure messaging system used for bank-to-bank communications. A SWIFT MT760 message is commonly used in SBLC monetization. This message confirms that the SBLC is blocked in favor of the monetizing entity and can be used as collateral for the financing.

- Collateral Verification: After the SWIFT MT760 has been sent, the monetizing bank verifies the SBLC and ensures that it meets their requirements. If approved, the financing entity agrees to provide funds based on a percentage of the SBLC’s value, which could range from 50% to 90%, depending on the terms and the issuing bank’s rating.

- Disbursement of Funds: Once the verification is complete, the monetizing entity will release the agreed-upon funds to the SBLC holder. The funds may be provided as a loan, a line of credit, or as cash for specific investments or projects. The SBLC remains in place as collateral throughout the process.

- Expiration or Repayment: The SBLC will eventually expire, typically after one year. By the expiration date, the SBLC holder is expected to repay the loan or line of credit. If they fail to do so, the financing entity can call upon the SBLC to recover the funds, ensuring that the loan is repaid.

Key Requirements for SBLC Monetization

Not all SBLCs qualify for monetization. For an SBLC to be eligible, it must meet several key criteria:

- Issued by a Reputable Bank: The SBLC must come from a top-tier bank with a strong credit rating. Monetizing institutions generally prefer SBLCs from international, well-rated banks.

- SWIFT Issued: The SBLC must be transmitted via the SWIFT network, ensuring secure and traceable communication between banks. In particular, SWIFT MT760 is crucial for blocking the SBLC as collateral in favor of the monetizing institution.

- Cash-Backed: The SBLC must be backed by cash in the issuing bank account. Non-cash-backed SBLCs are generally not accepted for monetization.

- Active and Valid: The SBLC must be active, fully validated, and typically have a validity period of one year. The SBLC should not have any restrictions that limit its use as collateral.

Types of SBLC Monetization

- Recourse Loans: In this scenario, the loan must be repaid by the borrower. The SBLC serves as collateral, and if the loan defaults, the lender may seize the SBLC or its equivalent value.

- Non-Recourse Loans: A more attractive option for borrowers, non-recourse loans do not require repayment. The SBLC is fully monetized, and the lender generates profits through high-return investments, such as trading programs. Since the SBLC backs the loan, the borrower does not need to repay the principal. This type of financing is often structured with the monetizer taking over the SBLC and offering a loan based on a percentage of its face value, typically 65% to 75%.

Implications of SBLC Monetization

- Increased Liquidity: Monetizing an SBLC allows businesses to access cash or credit without the need to sell assets or seek out more traditional, and often slower, forms of financing.

- Collateral Requirement: The SBLC must be issued by a reputable institution, and the monetizer must trust that the SBLC will stand as viable collateral in case of default.

- Cost: Monetizing an SBLC comes with costs, including fees for setting up the SWIFT MT760 message, interest rates, and other associated administrative costs.

- Repayment Obligation: The SBLC holder is responsible for repaying the loan or line of credit by the time the SBLC expires. Failure to do so could result in the monetizing institution claiming the SBLC for repayment.

Interested in SBLC Monetization?

At Tresore Capital Partners, we specialize in SBLC monetization and helping our clients unlock the full potential of their financial instruments. If you have an SBLC and are looking to monetize it for immediate liquidity or business financing, contact us today. Our expert team will guide you through the process and help you take advantage of this efficient form of collateral-based financing.